Homeowner Articles

Spring Cleaning? Don’t Forget Your Homeowners Insurance

Spring has officially arrived. Daylight Saving Time has returned. And as the weather turns warmer, many people are taking part in the ritual of spring cleaning. This practice often involves…

Spring Safety Tips for Homeowners

As the days get longer and temperatures climb, many people tackle spring cleaning chores as they air out their homes and spend more time outdoors. We invite you to add…

12 Tips to Avoid Kitchen Fires (and What to Do if One Occurs)

It isn’t just sharp knives and overindulgence in cooking wine that makes kitchens dangerous places. According to the National Fire Protection Association (NFPA), cooking fires are the leading cause of…

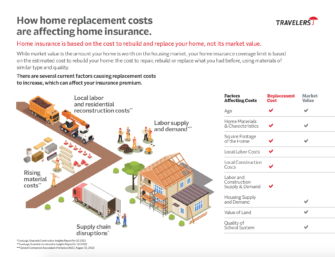

Home Replacement Cost vs. Market Value: What’s the Difference?

Homeowners often wonder why their home's replacement cost differs from its market value and how those two numbers should affect homeowners insurance decisions. Your home’s replacement cost reflects what it…

Warning Signs Your Home Could Need a New Roof

The roof is one of the most essential—and expensive—parts of your home. While a roof is built to last years, it will need to be eventually replaced. Also, the actual…

Eco-Friendly Appliances Offer Long-Term Savings and Environmental Benefits

When it comes time to replace appliances, low- to mid-price devices can save money up front while eco-friendly appliances typically carry a higher price tag. It can be tempting to…

Keep Your Basement Dry with These Tips

Nothing strikes terror into a homeowner’s heart like coming home to water flooding the basement. Unfortunately, climate change has made basement floods increasingly common. It’s not only a pain to…

Christmas Tree Disposal Options for New Yorkers

As fun and festive as the holiday season tends to be, the post-holiday cleanup is never fun. And disposing of a Christmas tree is often one of the most daunting…

5 New Year’s Resolutions for Insurance Policyholders

The start of the year is a great time to think about upcoming changes and how to prepare for any unique challenges and adventures ahead. Consider making the following five…

Does Your Family Have a Home Safety Checklist?

Not unlike home inventories, many people don’t think about creating and maintaining a home safety checklist. Fortunately, most of us feel safe in our homes, and we don’t spend much…